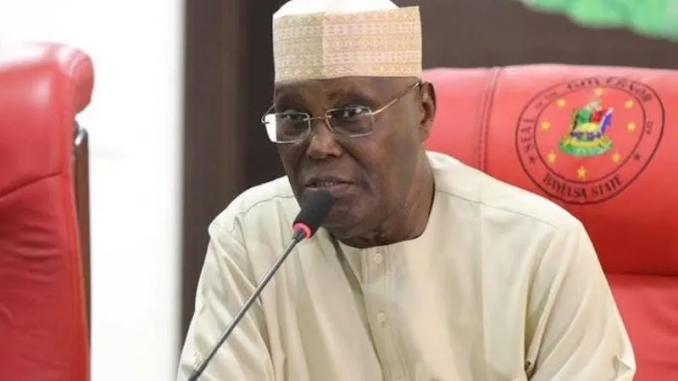

Former Vice President Atiku Abubakar has demanded that the Nigerian National Petroleum Corporation Limited (NNPCL) be immediately listed on the stock exchange by the Petroleum Industry Act.

Atiku said this in reaction to the NNPCL‘s decision to hand over the Warri and Kaduna refineries to private operators, who are expected to manage and operate them.

“The NNPCL is supposed to have been listed on the stock exchange in line with the Petroleum Industry Act. This would make the company more profitable and enhance transparency and corporate governance.

“Currently, the NNPCL claims to be private, but this is only a ruse to fool the feeble-minded because it remains the ATM of the Federal Government. Anything short of listing the NNPCL on the stock exchange is nothing but a cosmetic development,” he added.

Atiku, in a statement, further stated that the NNPC Limited continues to provide a cover of political protection to the Tinubu government’s policy inconsistency on the payment of subsidy, raising questions about the independence that the PIA requires of the NNPC Limited as a private business concern.

The Peoples Democratic Party (PDP) Presidential candidate said previous arrangements and concessions had not worked because of a lack of transparency in the contract award process and the government‘s failure to attract investors.

The former Vice President said that for such a deal to succeed, the Bureau of Public Enterprise (BPE) and a credible technical partner like Standard and Poor’s must be involved.

Atiku added, “Former President Olusegun Obasanjo revealed recently that even Shell, one of the world’s wealthiest oil companies, rejected the offer to operate Nigeria’s refineries. This is because the NNPCL has, for years, been a cesspool of endemic corruption.

“This is why over $20bn spent on the refineries in the last 20 years has led to nowhere. It is also curious that a government still paying petrol subsidy is trying to make its refineries profitable. Which businessman will invest in a refinery programmed to operate at a loss?”

Atiku questioned the feasibility of the NNPC’s latest plan even though he pointed out that such arrangements had not been profitable.

He added, “The manage-and-operate approach has not always worked. Manitoba Hydro International handed the Transmission Company of Nigeria, which led nowhere. Similarly, Global Steel Limited, given to the Ajaokuta Steel Company, could not make the facility profitable.

“The contract was questionably revoked by the Umaru Musa Yar’Adua administration, and Nigeria ended up paying Global Steel a compensation of nearly $500m while Ajaokuta remains comatose 17 years later.”

The Waziri Adamawa advised the NNPCL to keep the contract process open as it did with OVH last year. This was dubious and has still failed to boost the NNPCL’s petrol sufficiency, as evidenced by the months-long fuel scarcity.

“In 2022, Nueoil, an unknown and newly registered company, acquired OVH and Oando filling stations. Barely four months later, NNPCL Retail bought Nueoil and took control of all its assets, including the Oando filling stations.

“Barely eight months later, OVH turned around to take over NNPCL Retail. This convoluted transaction was done to hide the corruption involved. If this is the approach that the NNPCL wants to use in handing over its refineries to private hands, then Nigerians should not expect any positive development whatsoever.”

Leave a Reply